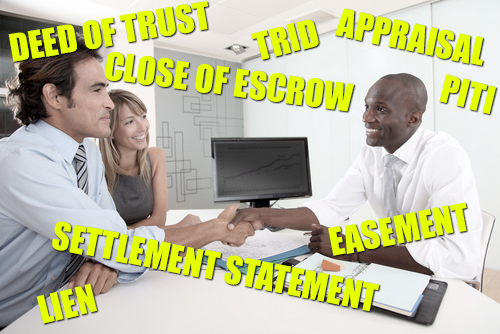

Know the Lingo

Appraisal

An estimate of value of property resulting from analysis of facts about the property; an opinion of value.

Annual Percentage Rate (APR)

The borrower’s costs of the loan term expressed as a rate. This is not their interest rate.

Beneficiary

The recipient of benefits, often from a deed of trust; usually the lender.

Closing Disclosure (CD)

Closing Disclosure form designed to provide disclosures that will be helpful to borrowers in understanding all of the costs of the transaction. This form will be given to the consumer three (3) business days before closing.

Close of Escrow

Generally, the date the buyer becomes the legal owner and title insurance becomes effective.

Comparable Sales

Sales that have similar characteristics as the subject real property, used for analysis in the appraisal. Commonly called “comps.”

Consummation

Occurs when the borrower becomes contractually obligated to the creditor on the loan, not, for example, when the borrower becomes contractually obligated to a seller on a real estate transaction. The point in time when a borrower becomes contractually obligated to the creditor on the loan depends on applicable State law. Consummation is not the same as close of escrow or settlement.

Deed of Trust

An instrument used in many states in place of a mortgage. In Arizona, deeds of trust are used more often than mortgages by lenders.

Deed Restrictions

Limitations on the deed to a parcel of real property that dictate certain uses that may or may not be made of the real property.

Disbursement Date

The date the amounts are to be disbursed to a buyer and seller in a purchase transaction, or the date funds are to be paid to the borrower or a third party in a transaction that is not a purchase transaction.

Earnest Money Deposit

Down payment made by a purchaser of real property as evidence of good faith; a deposit or partial payment.

Easement

A right, privilege, or interest limited to a specific purpose that one party has in the land of another.

Endorsement

As to a title insurance policy, a rider or attachment forming a part of the insurance policy expanding or limiting coverage.

Hazard Insurance

Real estate insurance protecting against fire, some natural causes, vandalism, etc. depending upon the policy. Buyer often adds liability insurance and extended coverage for personal property.

Impounds

A trust type of account established by lenders for the accumulation of borrower’s funds to meet periodic payments of taxes, mortgage insurance premiums, and/or future insurance policy premiums, required to protect their security.

Legal Description

A description of land recognized by law, based on government surveys, spelling out the exact boundaries of the entire parcel of land. It should so thoroughly identify a parcel of land that it cannot be confused with any other.

Lien

A form of encumbrance that usually makes a specific parcel of real property the security for the payment of a debt or discharge of an obligation. For example, judgments, taxes, mortgages, deeds of trust.

Loan Estimate (LE)

Form designed to provide disclosures that will be helpful to borrowers in understanding the key features, costs, and risks of the mortgage loan for which they are applying. Initial disclosure to be given to the borrower three (3) business days after application.

Mortgage

The instrument by which real property is pledged as security for repayment of a loan.

PITI

A payment that includes Principal, Interest, Taxes, and Insurance.

Power of Attorney

A written instrument whereby a principal gives authority to an agent. The agent acting under such a grant is sometimes called an “Attorney-in-Fact.”

Recording

Filing documents affecting real property with the appropriate government agency as a matter of public record.

Settlement Statement

Provides a complete breakdown of costs involved in a real estate transaction.

TRID

TILA/RESPA Integrated Disclosure Rule. TILA is the Truth in Lending Act and RESPA is the Real Estate Settlement Procedures Act. This rule is designed to help borrowers shop for a mortgage by requiring all mortgage lenders to disclose mortgage-related fees on the same forms. TRID combines two forms that were in use previously into one easy-to-understand form.

Comments

Be the first to leave a comment!

Leave a Comment

Just Browsing?

Our Scottsdale Elite Relocation guide is the perfect resource to help refine your buying decision.